How Instant Loan can Save You Time, Stress, and Money.

Wiki Article

Getting My Instant Loan To Work

Table of ContentsGetting My $100 Loan Instant App To WorkSome Known Details About Best Personal Loans Best Personal Loans Fundamentals ExplainedA Biased View of Instant LoanAn Unbiased View of $100 Loan Instant AppThe 8-Second Trick For Best Personal Loans

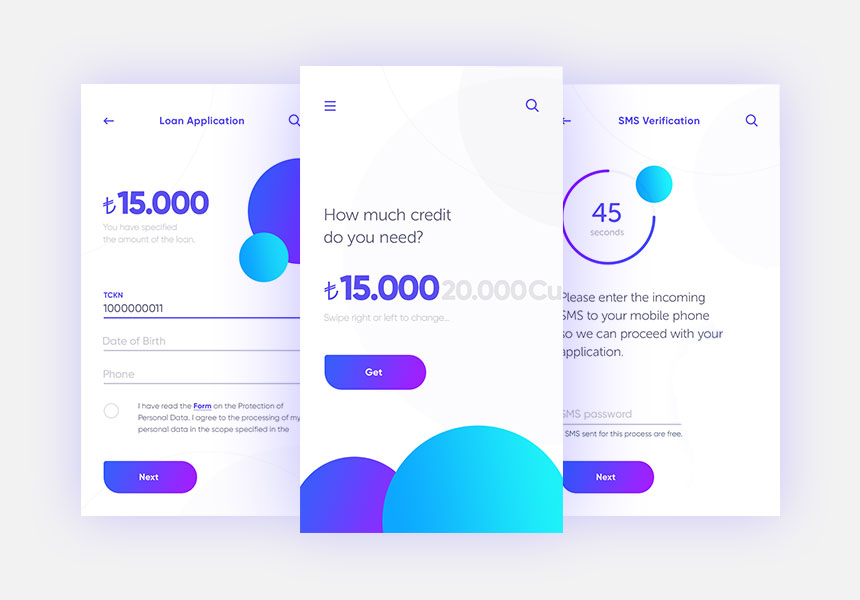

When we consider getting lendings, the images that enters your mind is people lining up in lines, waiting for countless follow-ups, and also getting absolutely frustrated. Modern technology, as we know it, has actually transformed the face of the lending company. In today's economic climate, consumers and not loan providers hold the secret.Car loan authorization and documentation to financing processing, everything is online. The numerous relied on online finance apps offer debtors a platform to apply for fundings easily and offer authorization in minutes. You can take an from some of the best money car loan applications available for download on Google Play Store and also App Store.

You just have to download the app or go to the Pay, Sense internet site, sign up, publish the called for records, and also your car loan will get approved. You will get alerted when your car loan request is processed.

How $100 Loan Instant App can Save You Time, Stress, and Money.

Often, also after obtaining your finance approved, the procedure of obtaining the finance amount moved to you can take time as well as obtain made complex. That is not the case with on the internet loan apps that supply a direct transfer choice. Instantaneous funding applications use instant personal finances in the range of Rs.

5,00,000 - instant loan. You can use an immediate loan as per your qualification and also need from immediate lending apps. You don't have to fret the following time you desire to obtain a small-ticket finance as you know how useful it is to take a finance using on the internet funding apps. So, do away with the taxing and tiresome process of get standard personal financings.

The Best Strategy To Use For Loan Apps

You can be sure that you'll get a reasonable rate of interest price, tenure, car loan amount, as well as other benefits when you take a car loan with Pay, Sense Online Lending Application.An electronic loaning platform covers the whole car loan lifecycle from application to dispensation right into customers' bank accounts. By digitizing and also automating the loaning process, the platform is changing standard banks right into digital lenders. In this post, let's discover the benefits that a digital lending platform can offer the table: what remains in it for both banks and their consumers, as well as how electronic lending systems are disrupting the sector.

Every bank now wants everything, including car loans, to be refined quickly in real-time. Consumers are no longer prepared to wait for days - not to mention to leave their houses - for why not find out more a finance.

The Best Guide To Instant Loan

Today's Gen, Z and millennials can not live without their mobile phone. All of their daily activities, consisting of economic purchases for all their tasks and they prefer doing their financial deals on it as well. They want the comfort of making purchases or getting a funding anytime from anywhere. It's extremely hard to please.In this case, digital lending systems function as a one-stop option with little manual data input as important site well as quick turnaround time from lending application to cash in the account. Clients must be able to move perfectly from one device to an additional to complete the application forms, be it the internet as well as mobile user interfaces.

Companies of digital lending systems are needed to make their products in conformity with these guidelines and also help the lenders concentrate on their company only. Lenders additionally should see to it that the carriers are updated with all the most recent standards provided by the Regulatory authorities to quickly include them into the electronic lending system.

All About Best Personal Loans

As time passes, electronic loaning platforms can aid save 30 to 50% expenses expenses. The traditional hand-operated loaning system was a pain for both loan provider and also debtor. It depends on human treatment and physical communication at every action. Clients had to make several journeys to the banks and also send all type of papers, and manually complete numerous kinds.The Digital Loaning platform has transformed the way banks assume regarding and also execute their financing procurement. Financial institutions can currently deploy a fully-digital funding cycle leveraging the most recent developments. A great digital lending platform need to have very easy application submission, quick approvals, compliant loaning procedures, and the capability to continually improve process effectiveness.

If you're believing of going into borrowing, these right here are comforting numbers. At its core, fintech is all about making traditional monetary processes quicker and also extra reliable.

The Instant Cash Advance App Ideas

Among the common misunderstandings is that fintech apps just profit financial establishments. That's not totally real. The application of fintech is currently spilling from financial institutions and also lenders to local business. This isn't unusual, since small companies require automation and digital technology to optimize their restricted resources. Marwan Forzley, CEO of the settlement platform Veem, sums it best: "Local business are seeking to outsource intricacy to someone else due to the fact that they have sufficient to fret around.A Kearney research backs this up: Source: Kearney As you can see, the convenience of usage tops the list, revealing how ease of access and ease provided by fintech systems represent a significant driver for client loyalty. You can apply many fintech innovations to drive client count on as well as retention for services.

Report this wiki page